Purchase Order (PO) financing offers Small and Medium Enterprises (SMEs) access to working capital before completing sales, helping them overcome cash flow challenges. To apply successfully, businesses must pre-qualify by assessing their financial health, demonstrating stable cash flow, and organizing supply chain relationships. A comprehensive application includes accurate financial records, detailed purchase orders, and a project timeline. The approval process requires strategizing document preparation, meeting deadlines, and maintaining transparent communication with lenders to increase chances of success in securing PO financing.

Looking to streamline your business cash flow with purchase order (PO) financing? This guide navigates the process of applying for PO financing, from understanding its benefits to securing approval. First, grasp the essence of PO financing and why it’s a powerful tool for businesses. Then, pre-qualify by assessing your company’s financial health. Learn what documents are crucial for a compelling application. Finally, discover tips for success and pitfalls to avoid during the approval process when applying for PO financing.

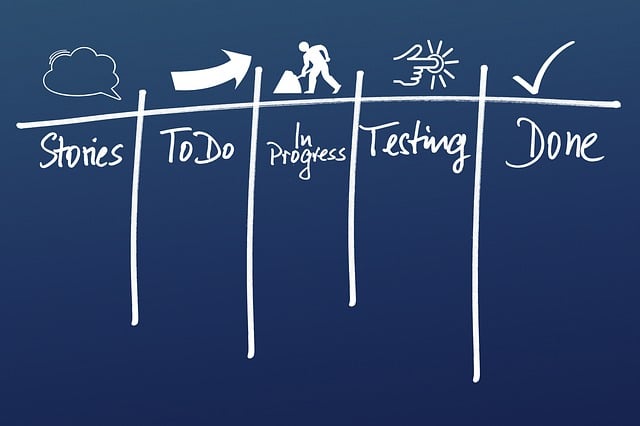

- Understanding Purchase Order (PO) Financing: What It Is and Why It Matters

- Pre-qualifying for PO Financing: Steps to Take Before Applying

- Assembling a Compelling Application: Documents and Information Needed

- Navigating the Approval Process: Tips for Success and Common Pitfalls to Avoid

Understanding Purchase Order (PO) Financing: What It Is and Why It Matters

Purchase Order (PO) financing is a strategic funding method that enables businesses, especially small and medium-sized enterprises (SMEs), to access working capital before completing a sale. It’s a powerful tool for navigating cash flow challenges, as it provides upfront funding against approved purchase orders from customers. This means businesses can secure payment for goods or services they’ve already provided but haven’t yet received full payment for.

When applying for PO financing, understanding the process is key. Lenders assess each purchase order individually, considering factors like the creditworthiness of both the buyer and supplier, the order amount, and the expected repayment terms. This approach allows businesses to tap into future sales, offering a flexible funding solution that can enhance cash flow management and support growth aspirations.

Pre-qualifying for PO Financing: Steps to Take Before Applying

Before diving into the application process for Purchase Order (PO) financing, it’s crucial to pre-qualify. This step ensures that your business meets the basic criteria set by lenders, increasing your chances of a successful application. Start by evaluating your company’s financial health and ensuring you have solid accounting records. Verify that your PO financing requirements align with the lender’s guidelines; this includes understanding the types of goods or services you plan to finance and the associated costs.

Next, assess your cash flow management skills. Lenders want to see a consistent and stable cash flow to ensure repayment capability. Prepare documentation that demonstrates your ability to manage and predict cash inflows and outflows. This might include providing historical financial statements, sales projections, or detailed expense reports. Additionally, have your supply chain and vendor relationships in order, as these will play a significant role in the financing process.

Assembling a Compelling Application: Documents and Information Needed

When assembling an application for purchase order (PO) financing, it’s crucial to include comprehensive and accurate documentation. This process is essential for demonstrating your business’s financial health and creditworthiness to potential lenders. Key documents required may include financial statements, tax returns, and bank statements. These provide insights into your company’s revenue, expenses, and overall financial stability.

Additionally, gathering information such as detailed purchase orders, vendor details, and a clear project timeline is vital. Lenders need to understand the purpose of the financing, the nature of the purchases, and how the funds will be utilized. A well-organized application, with all necessary documents and data presented clearly, increases your chances of securing PO financing successfully.

Navigating the Approval Process: Tips for Success and Common Pitfalls to Avoid

Navigating the approval process for purchase order (PO) financing can be a complex task, but with the right approach, you can increase your chances of success. Start by thoroughly understanding your company’s financial standing and the specific requirements of the PO financing application. Ensure all necessary documents are in order, including accurate financial statements, sales projections, and detailed supplier information. Organize these documents chronologically to streamline the review process.

When applying for PO financing, avoid common pitfalls such as missing deadlines, providing incomplete or inaccurate data, or failing to meet supplier criteria. Be transparent about your company’s financial history and any potential risks involved. Regularly communicate with the financier throughout the process to address concerns promptly. Remember, clear communication and thorough preparation are key to a successful application for PO financing.