PO financing application tips empower SMEs to access working capital tied up in outstanding vendor invoices, enhancing cash flow management and avoiding lengthy waiting periods. This method requires understanding business operations and supplying detailed financial statements and projections. Digitalizing applications through cloud-based platforms speeds up the process and improves success rates. Essential documents include purchase orders, financial statements, contract details, supplier information, and order terms. Regular communication with suppliers, prompt payments, and a robust credit profile are key strategies for effective navigation in the PO financing landscape.

“Unleash the power of Purchase Order (PO) financing to revolutionize your business cash flow! This comprehensive guide provides essential insights into the world of PO financing applications, offering valuable tips for businesses seeking to optimize their financial strategies. From understanding the benefits and navigating application requirements to exploring digital solutions and key documents, we demystify the process. Learn how to overcome common challenges and best practices to ensure a successful PO financing application, empowering your business with efficient cash management.”

- Understanding PO Financing and Its Benefits

- Essential Application Requirements for Purchase Orders

- Streamlining the Application Process: Digital Solutions

- Key Documents Needed for Effective PO Financing

- Common Challenges and How to Overcome Them

- Best Practices for a Successful PO Financing Application

Understanding PO Financing and Its Benefits

Purchase order (PO) financing is a powerful tool that enables businesses, especially small and medium-sized enterprises (SMEs), to unlock working capital tied up in outstanding vendor invoices. It provides an alternative to traditional lending methods by allowing companies to obtain funds based on their existing purchase orders with suppliers. This innovative approach streamlines cash flow management, as businesses can access liquidity before the payment due date, eliminating the need for lengthy waiting periods between order placement and invoice settlement.

The benefits of PO financing are numerous. It offers improved cash position, enabling firms to better manage operational expenses, seize market opportunities, or invest in growth strategies. By enhancing financial flexibility, PO financing application tips can help businesses maintain a strong relationship with their suppliers, as it provides a mutually beneficial solution that ensures timely payments without the need for extensive credit checks or collateral.

Essential Application Requirements for Purchase Orders

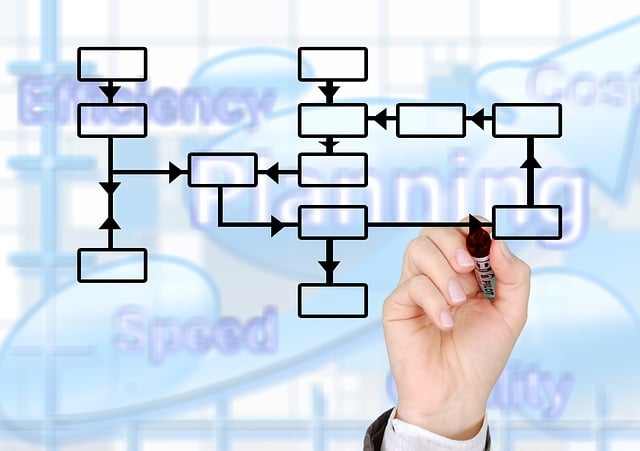

When crafting a Purchase Order (PO) financing application, several key requirements stand out as essential. Firstly, a comprehensive understanding of your business operations and cash flow patterns is crucial. Lenders need to assess if your company has a steady and predictable cash flow to support PO financing. Providing detailed financial statements and projections can greatly facilitate this evaluation.

Additionally, a solid and reliable supplier network is another vital requirement. Lenders will want to see that you have established relationships with trustworthy suppliers, who can provide timely and accurate invoices for the goods or services acquired through POs. Demonstrating these PO financing application tips shows lenders that your company has a robust system in place, reducing risk and enhancing the overall viability of the financing request.

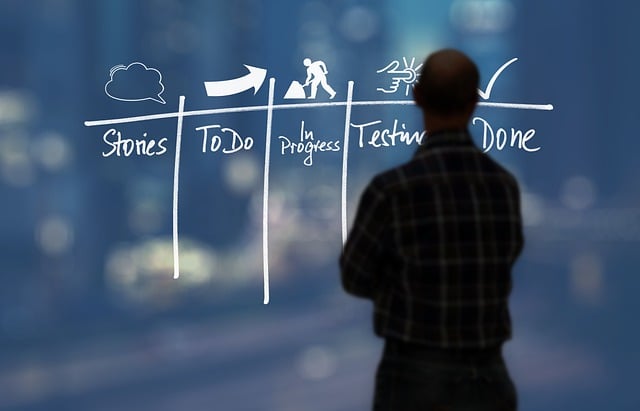

Streamlining the Application Process: Digital Solutions

In today’s digital era, streamlining the PO financing application process is more crucial than ever for businesses seeking efficient cash flow management. Digital solutions offer a seamless and faster alternative to traditional paper-based methods. By implementing online platforms and automated systems, companies can significantly enhance their application tips. These platforms allow for quick data input, instant document uploads, and real-time tracking of the entire process, eliminating delays caused by manual data entry and physical paperwork.

Moreover, digital PO financing applications provide a secure and centralized repository for all relevant information. This not only ensures easy access for both applicants and lenders but also reduces the risk of data loss or manipulation. With just a few clicks, businesses can submit their applications, receive approvals promptly, and gain faster access to funds, fostering a more efficient and responsive financial ecosystem.

Key Documents Needed for Effective PO Financing

When applying for PO (Purchase Order) financing, having the right documents is crucial to a smooth and successful process. Key documents required often include detailed purchase orders from reputable suppliers, along with financial statements such as balance sheets and income statements. These documents provide a clear picture of your company’s financial health and its ability to repay the financing.

Additionally, PO financing application tips suggest including contract details, supplier information, and any relevant terms and conditions specific to the purchase order. It’s also beneficial to have historical data on similar transactions, demonstrating your company’s track record in managing such arrangements. Ensuring these documents are accurate and up-to-date significantly enhances your chances of securing PO financing.

Common Challenges and How to Overcome Them

Many businesses, especially small and medium-sized enterprises (SMEs), face challenges when it comes to accessing working capital for their operations, which is where PO financing application tips come into play. One common hurdle is the time-consuming nature of traditional financing methods. To streamline this process, businesses should consider digitalizing their purchase order (PO) financing requests. By utilizing cloud-based platforms and automated systems, companies can quickly submit POs and receive funding offers from various lenders, speeding up cash flow.

Another obstacle is securing favorable terms and rates. To overcome this, it’s essential to build a strong vendor relationship with financing providers. Regular communication, prompt payment of invoices, and maintaining a healthy credit profile will enhance your negotiating power. Additionally, comparing multiple PO financing options and understanding the associated fees and interest rates can help businesses secure more competitive terms tailored to their specific needs.

Best Practices for a Successful PO Financing Application

When applying for Purchase Order (PO) financing, businesses should adopt several best practices to enhance their chances of success. Firstly, ensure your PO financing application tips are accurate and comprehensive; include detailed information about the products or services involved, expected delivery dates, and any specific terms or conditions. A well-prepared application demonstrates professionalism and reduces potential risks for the financier.

Additionally, maintain strong working relationships with suppliers and keep open lines of communication. This collaboration can streamline the PO financing process, ensuring timely submissions and accurate documentation. Regularly reviewing and updating your financial records is another crucial practice; accuracy in cash flow projections and overall financial health boosts trustworthiness and increases the likelihood of securing favorable financing terms.