Purchase Order (PO) financing is a strategic solution for businesses aiming to boost cash flow by using their sales orders as collateral. To apply successfully, companies must meet strict eligibility criteria, including strong credit history and timely supplier payments. The process involves preparing meticulous applications with detailed purchase orders and transparent financial information. Following specific tips, such as offering collateral and demonstrating industry knowledge, increases the chances of securing PO financing for business growth and efficient operations.

Looking to streamline your business cash flow with purchase order (PO) financing? This comprehensive guide provides essential insights into navigating the application process. From understanding PO financing fundamentals to maximizing your chances of approval, we cover it all. Learn about eligibility criteria, the step-by-step application process, and valuable tips for a successful PO financing application. Discover how to unlock funding opportunities and fuel your business growth today with these expert guidelines.

- Understanding Purchase Order Financing: An Overview for Businesses

- Eligibility Criteria: What You Need to Meet Before Applying

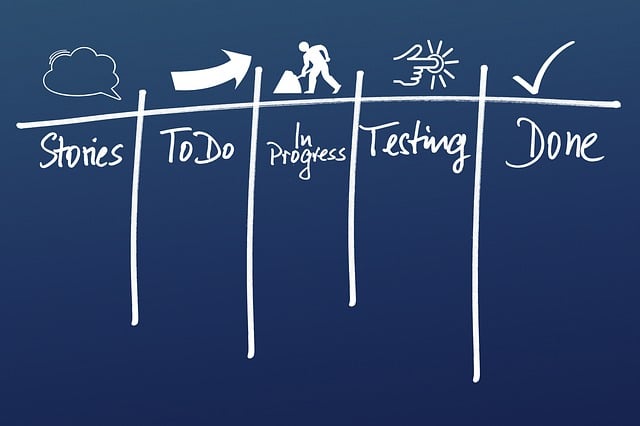

- The Application Process: Step-by-Step Guide to Securing PO Financing

- Maximizing Your Chances: Tips and Best Practices for a Successful PO Financing Application

Understanding Purchase Order Financing: An Overview for Businesses

Purchase Order (PO) financing is a powerful tool that allows businesses to unlock cash flow by financing their purchases. It’s an alternative funding option for companies looking to streamline their operations, manage cash flow more effectively, and gain access to immediate funds. Understanding PO financing involves grasping how it works and the benefits it offers.

When a business applies for purchase order financing, they are essentially seeking a loan based on their existing or anticipated sales orders. The financier assesses the creditworthiness of the business and its customers before agreeing to fund the purchases. This process streamlines the payment process by eliminating the need for traditional billing and payments, enabling businesses to focus on growing their operations and meeting customer demands. PO financing application tips include preparing detailed purchase orders, maintaining strong vendor relationships, and demonstrating a solid track record of timely payments.

Eligibility Criteria: What You Need to Meet Before Applying

Before applying for purchase order (PO) financing, businesses should ensure they meet specific eligibility criteria. This includes having a strong credit history and a solid track record of timely payments to suppliers. Lenders will assess your financial health based on factors like credit scores, revenue streams, and cash flow management. Demonstrating consistent and responsible purchasing behavior is crucial, as it shows the lender that you can effectively manage and repay the financing.

Additionally, businesses seeking PO financing should have a stable supplier base and a clear understanding of their purchase order pipeline. Lenders often look for evidence of long-term relationships with suppliers, as this reduces risk. Having well-defined procurement processes and a clear sense of your inventory management will also strengthen your application. These tips can help guide you through the PO financing application process, making it easier to secure the funding needed for business growth.

The Application Process: Step-by-Step Guide to Securing PO Financing

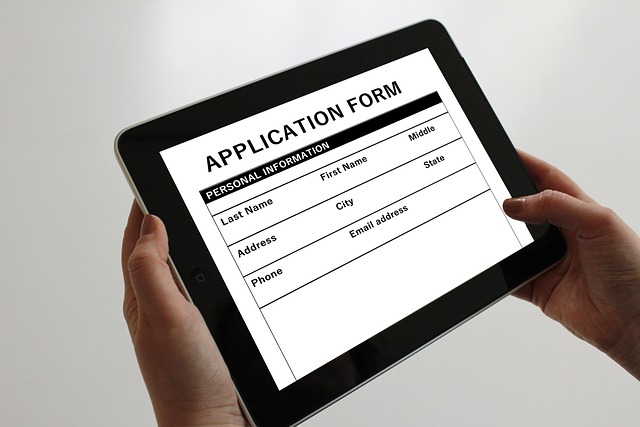

Applying for purchase order (PO) financing can be a straightforward process if approached methodically. The first step is to assess your business’s financial health and determine your requirements. Evaluate current cash flow, outstanding debts, and upcoming purchases that warrant financing. This self-assessment will help tailor your application accordingly.

Next, gather essential documents such as business registration certificates, tax identification numbers, and financial statements. These documents are crucial for verifying your business’s creditworthiness. Many PO financing providers offer online applications, making the process convenient. Fill out the form accurately, providing detailed information about your business, industry, and intended purchases. Be transparent about any financial constraints or challenges to build trust with potential lenders. Following these PO financing application tips increases your chances of securing the funding needed for seamless business operations.

Maximizing Your Chances: Tips and Best Practices for a Successful PO Financing Application

When applying for purchase order financing, businesses should be prepared with a strong application to maximize their chances of approval. The PO financing application process involves demonstrating financial stability, a solid business plan, and a reliable supply chain. Start by ensuring your company’s financial statements are up-to-date and accurately reflect your business health. This includes revenue projections, profit margins, and cash flow analysis. Lenders will want to see consistent growth trends and a manageable debt-to-equity ratio.

Prepare detailed information about the purchase orders you intend to finance. Provide a clear description of the products or services, expected delivery dates, and the terms of each order. Highlight any long-term relationships with suppliers, as this can strengthen your application. Additionally, PO financing application tips include offering collateral if possible, such as inventory or equipment, to secure the loan. Demonstrating a thorough understanding of your industry and market position will also enhance your proposal. Remember, a well-structured and transparent application increases the likelihood of securing the desired purchase order financing.