Purchase Order (PO) financing offers businesses immediate capital by transforming future revenue into working capital. To apply, companies prepare documents like financial statements and PO details, assess creditworthiness, and meet industry standards. Securing PO financing enhances cash flow, operational capabilities, and market responsiveness, enabling businesses to expand and capitalize on opportunities. A strategic application process, thorough preparation, and ongoing communication with financiers maximize the benefits of PO financing for sustained growth.

“Unlock capital for your business with purchase order (PO) financing—a strategic approach to funding that supports growth and improves cash flow. This comprehensive guide walks you through the entire PO financing application process, from understanding the benefits to maximizing post-approval gains. Learn how to prepare your business, master key application components, and navigate approval with expert tips. Discover the power of PO financing to secure the funds needed for success.”

- Understanding Purchase Order Financing: Unlocking Capital for Businesses

- Preparing Your Business for the PO Financing Application Process

- The Key Components of a Successful Purchase Order Financing Application

- Navigating the Approval Process: Tips to Increase Your Chances of Success

- Maximizing the Benefits of Purchase Order Financing After Approval

Understanding Purchase Order Financing: Unlocking Capital for Businesses

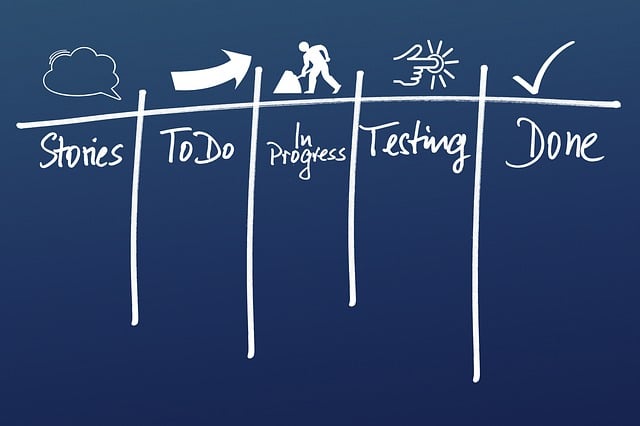

Purchase Order (PO) financing is a powerful tool that allows businesses to unlock capital tied up in their pending orders. It’s an innovative way for companies, especially those with strong purchase order backlogs, to gain access to much-needed working capital before the completion and payment of these orders. By applying for PO financing, businesses can transform their future revenue into immediate funds, providing a significant boost to cash flow and operational capabilities.

This process involves submitting a PO financing application, which typically includes details about the purchase order, the supplier, and the expected timeline. Lenders or financial institutions review these applications, assessing factors like creditworthiness, order volume, and industry reputation. Upon approval, businesses can receive funding based on the value of their pending orders, enabling them to meet immediate financial obligations, expand operations, or seize market opportunities without delay.

Preparing Your Business for the PO Financing Application Process

Preparing Your Business for the PO Financing Application Process

Before diving into the application process for purchase order (PO) financing, it’s crucial to ensure your business is well-positioned to make a compelling case. This involves organizing and preparing essential documents such as financial statements, tax returns, and banking information. These documents not only serve as proof of your company’s financial health but also help lenders assess your creditworthiness and the potential risk associated with financing your PO. Additionally, reviewing and understanding the specific requirements for applying for PO financing is vital. This includes clarifying the types of purchases eligible for financing, any minimum or maximum funding thresholds, and any additional criteria that may be considered during the approval process.

Engaging in a thorough internal review to identify potential red flags or areas of concern is also recommended. Addressing these issues proactively demonstrates your business’s proactivity and responsibility to lenders. Furthermore, ensuring compliance with all relevant regulations and industry standards shows your commitment to ethical practices. Lastly, consider reaching out to PO financing providers for guidance or clarifications on the application process. Their insights can be invaluable in navigating the steps and increasing your chances of securing successful PO financing.

The Key Components of a Successful Purchase Order Financing Application

When applying for purchase order (PO) financing, a well-structured and comprehensive application is key to success. The first step involves gathering all essential documents, including your business registration details, financial statements, and PO from the supplier. These documents provide a clear picture of your company’s creditworthiness and help lenders assess the risk associated with offering financing.

The application process also requires outlining the purchase order details, such as the supplier, product/service description, and expected delivery date. Clearly communicating these aspects demonstrates to potential lenders that the transaction is legitimate and reduces the chances of delays or disputes. Additionally, including a solid business plan or financial projections can strengthen your PO financing application, showcasing your company’s growth potential and ability to repay the loan.

Navigating the Approval Process: Tips to Increase Your Chances of Success

Navigating the approval process for a purchase order (PO) financing application can be seamless with the right approach. Start by thoroughly understanding your company’s financial standing and ensuring all required documentation is up-to-date. This includes accurate financial statements, tax records, and business registration documents. When applying for PO financing, present a clear picture of your business’s creditworthiness to increase your chances of success.

Next, carefully review the terms and conditions offered by the financier. Pay close attention to interest rates, repayment periods, and any collateral requirements. Be prepared to provide detailed information about the goods or services you intend to purchase, including vendor details and delivery schedules. Demonstrating a well-thought-out plan for managing cash flow and adhering to PO terms will enhance your application’s appeal.

Maximizing the Benefits of Purchase Order Financing After Approval

After successfully applying for and securing purchase order (PO) financing, businesses can maximize its benefits by implementing strategic practices. Firstly, utilize the financial flexibility to fund more projects or expand operations, ensuring a steady cash flow and enabling growth opportunities. PO financing allows you to separate the procurement process from your cash management, providing a safety net against unexpected cash shortages during peak spending seasons.

Additionally, maintain open communication with your financier throughout the application process and beyond. Regularly review and assess your financial standing and ensure compliance with the agreed-upon terms. This proactive approach will help secure continued access to PO financing in the future, fostering a robust and sustainable supply chain management strategy.