Securing purchase order (PO) financing is a modern solution for small and medium-sized enterprises (SMEs), offering immediate cash flow by converting outstanding POs into liquid funds. This method streamlines financial operations, improves cash management, and enhances supplier relationships. Before exploring PO financing, assess your business needs, growth goals, and challenges to identify the ideal features of standalone or integrated solutions. The application process involves evaluating credit history, comparing financing options, and choosing a model that aligns with industry standards and financial implications.

Navigating purchase order (PO) financing applications can be a complex task, but understanding this process is crucial for businesses seeking to streamline their cash flow. This article guides you through securing PO financing, starting with an overview of what it entails and its benefits. We then delve into assessing your business needs, exploring application types, and providing a step-by-step approach to successfully apply. By the end, you’ll be equipped to make informed decisions in securing PO financing.

- Understanding Purchase Order Financing and Its Benefits

- Assessing Your Business Needs for Securing POs

- Exploring Different Application Types and Options

- Steps to Successfully Apply for Purchase Order Financing

Understanding Purchase Order Financing and Its Benefits

Purchase order financing is a powerful tool that allows businesses, especially small and medium-sized enterprises (SMEs), to unlock immediate cash flow by converting their outstanding purchase orders into readily available funds. This innovative funding method provides a flexible and efficient way to manage working capital, enabling companies to bridge the gap between placing an order and receiving payment from customers. By securing purchase order financing, businesses can streamline their financial operations, improve cash management, and gain access to the capital needed for growth and expansion.

The benefits of this financing option are numerous. It offers a faster alternative to traditional loan applications, often with less stringent requirements, making it more accessible to companies with limited credit history or assets. Additionally, it aligns perfectly with the modern digital supply chain, as many platforms now offer automated purchase order financing solutions, simplifying the process for both buyers and suppliers. This approach can also enhance business relationships by providing a financial safety net during transactions, fostering trust between partners.

Assessing Your Business Needs for Securing POs

Before diving into the world of purchase order (PO) financing applications, it’s crucial to assess your business needs. Understanding why you require PO financing is the first step in navigating this process effectively. Securing PO financing can be a game-changer for businesses looking to streamline their cash flow and gain access to immediate funds for inventory purchases. It’s particularly beneficial if your company operates on tight payment terms with suppliers or experiences seasonal fluctuations in demand, requiring flexible funding options.

By evaluating your business’s unique circumstances, you can identify the specific features and advantages offered by different PO financing applications. For instance, some platforms cater to small businesses seeking quick access to capital for urgent inventory needs, while others target larger enterprises with complex supply chain management requirements. Assessing your current financial situation, growth goals, and potential challenges will help you make informed decisions when choosing a PO financing solution tailored to your business’s health and future prospects.

Exploring Different Application Types and Options

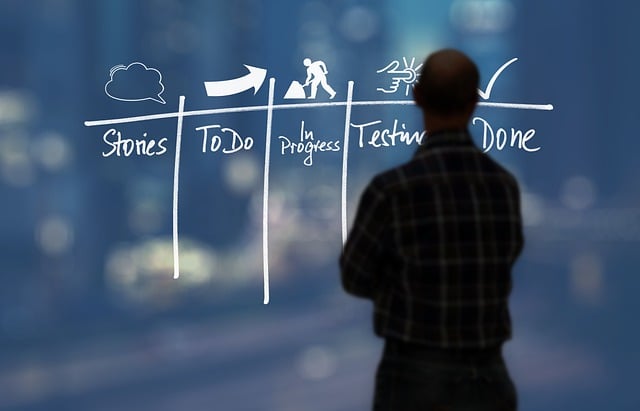

When exploring purchase order financing applications, understanding the diverse types available is key to securing the best option for your business needs. There are two primary categories: standalone applications and integrated solutions. Standalone apps are specialized platforms designed explicitly for managing and facilitating POs, offering features like document management, approval workflows, and real-time tracking. These tools are ideal for companies seeking a focused solution to streamline their purchase order processes.

On the other hand, integrated financing applications form part of broader financial management software suites. They offer more comprehensive services by integrating POs with accounting, inventory, and supply chain management systems. This integration provides a seamless experience, allowing businesses to manage their entire financial ecosystem from a single platform. Such solutions are particularly advantageous for larger enterprises with complex financial operations, as they enable better data synchronization and decision-making.

Steps to Successfully Apply for Purchase Order Financing

Navigating the application process for purchase order (PO) financing can seem daunting, but with a structured approach, businesses can successfully secure this financial tool to streamline their operations. Here’s a step-by-step guide to applying for PO financing:

1. Assess Your Needs and Eligibility: Begin by understanding your business requirements and whether PO financing aligns with your goals. Evaluate your credit history and financial health, as lenders will consider these factors. Ensure you meet the basic eligibility criteria set by PO financing providers, such as having a strong vendor relationship and fulfilling specific industry standards.

2. Choose a Financing Option: Explore different PO financing models like traditional bank loans, factoring, or specialized PO financing platforms. Compare terms, interest rates, and fees to select the most suitable option for your needs. Some lenders offer tailored packages for specific industries, so research options aligned with your sector. Understanding the financial implications and terms will empower you to make an informed decision when securing purchase order financing.