Purchase Order (PO) financing is a strategic solution for businesses aiming to enhance cash flow by accessing funds from outstanding vendor invoices. To successfully apply, companies should follow these steps: assess their needs, prepare comprehensive financial documentation, research and compare lenders, accurately complete applications, offer collateral, present a compelling business case, demonstrate creditworthiness, understand PO terms, avoid common application mistakes, organize critical documents, build strong supplier relationships, and meet deadlines with complete information. Following these tips increases the likelihood of securing favorable funding terms for business purchases.

“Unleash the power of Purchase Order (PO) financing to streamline your business operations and unlock growth opportunities. This comprehensive guide navigates the intricate world of PO financing applications, offering a step-by-step approach to secure funding for your purchases.

From understanding the benefits of PO financing to identifying key application elements and avoiding common pitfalls, this article equips you with invaluable insights. Learn how to apply effectively, follow best practices, and master the art of securing PO financing to fuel your business’s success.”

- Understanding Purchase Order Financing and Its Benefits

- Steps to Apply for a Purchase Order Financing Application

- Key Elements of a Successful PO Financing Application

- Common Mistakes to Avoid During the Application Process

- Securing Purchase Order Financing: Tips and Best Practices

Understanding Purchase Order Financing and Its Benefits

Purchase Order (PO) financing is a powerful tool that allows businesses to unlock working capital tied up in outstanding vendor invoices. By applying for purchase order financing, companies can access funds before they receive payment from their customers, enabling them to cover immediate expenses and maintain smooth operations. This type of financing offers several advantages, including improved cash flow management, better ability to negotiate with vendors, and the opportunity to secure competitive pricing on inventory purchases.

The PO financing application process involves submitting detailed information about your business, financial history, and the specific purchase orders you need funding for. Lenders will evaluate these factors to determine eligibility and offer terms tailored to your needs. Following PO financing application tips, such as providing accurate data, demonstrating strong vendor relationships, and clearly outlining the intended use of funds, can increase your chances of securing favorable PO financing.

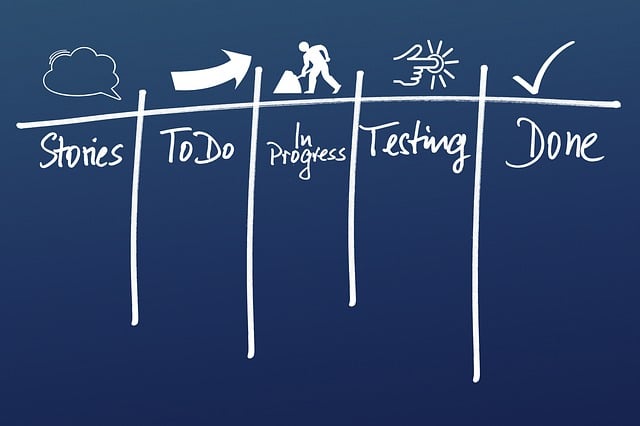

Steps to Apply for a Purchase Order Financing Application

Applying for Purchase Order (PO) financing is a strategic move for businesses seeking to streamline their cash flow and fund purchases efficiently. The process involves several key steps that, when followed diligently, can lead to successful securing of PO financing. Firstly, assess your business’s needs and identify the specific items or services you wish to purchase, ensuring these align with the eligibility criteria of PO financing providers. Next, prepare comprehensive documentation detailing your company’s financial health, including historical sales figures, accounts payable, and any relevant contracts or orders.

Once your documents are in order, research reputable PO financing applications and lenders that cater to your industry. Compare their terms, interest rates, and application requirements. Fill out the application form accurately, providing all necessary details about your business, the purchase order, and your expected repayment capacity. Keep in mind that a clear and concise application can expedite the review process. Additionally, be prepared to offer collateral or provide guarantees to enhance your application’s appeal.

Key Elements of a Successful PO Financing Application

When applying for purchase order (PO) financing, a robust and well-structured application is key to securing funding. The initial stages of the PO financing application process involve presenting a clear and compelling case to potential lenders or investors. A successful application should include detailed information about the business, its financial standing, and the specific PO that requires financing. This includes providing a comprehensive overview of the company’s history, current market position, and future growth prospects. Demonstrating a solid understanding of the industry dynamics and market trends is essential to showcase the viability of the purchase order.

Additionally, applicants should offer concrete evidence of their creditworthiness and ability to repay. This may involve presenting financial statements, credit reports, and other relevant documents that highlight the company’s financial health and stability. Well-prepared PO financing application tips include being transparent about any existing debts or financial obligations and demonstrating a clear strategy for managing cash flow during and after the purchase. Lenders will also appreciate a detailed breakdown of the PO terms, including timelines, payment structures, and any associated risks or benefits. A thorough and organized application increases the chances of approval and access to much-needed funds for businesses looking to expand their operations through PO financing.

Common Mistakes to Avoid During the Application Process

When applying for purchase order financing, many businesses make common mistakes that can hinder their chances of securing the funding they need. One of the primary errors is failing to prepare accurate and complete documentation. This includes missing or incorrect financial statements, inadequate sales projections, or incomplete tax records. Such oversights can delay the application process significantly.

Another mistake is not understanding the specific requirements of the PO financing application process. Each lender has its own set of criteria for evaluating applications. Neglecting to thoroughly read and follow these guidelines often leads to rejections due to minor compliance issues. Additionally, businesses should avoid over-promising their capabilities or inflating revenue projections. Lenders verify these figures, and discrepancies can reflect poorly on the applicant’s financial health and credibility.

Securing Purchase Order Financing: Tips and Best Practices

Applying for purchase order (PO) financing can be a strategic move for businesses looking to streamline their cash flow and fund purchases efficiently. However, navigating the PO financing application process requires careful consideration and preparation. Here are some tips to enhance your chances of securing successful PO financing:

Start by understanding your business’s financial position and eligibility criteria set by potential lenders. Organize relevant documents such as accounting records, purchase orders, and contracts to demonstrate a solid repayment capacity. Accurate financial statements will bolster your application, especially when applying for PO financing through financial institutions or banks. Prioritize building strong relationships with suppliers who offer flexible payment terms, as this can reduce the need for external financing in the long run. When ready to apply, thoroughly research different lenders and their requirements. Many provide online applications, making it easy to submit your details and necessary documents digitally. Ensure you meet all deadlines and provide complete information to avoid delays.